Term life insurance coverage commonly comes in fixed premium contract lengths of 10 15 20 25 and 30 years. The policys purpose is to give insurance to.

What Is Term Life Insurance Daveramsey Com

What Is Term Life Insurance Daveramsey Com

Term life policies have no value other than the guaranteed death benefit.

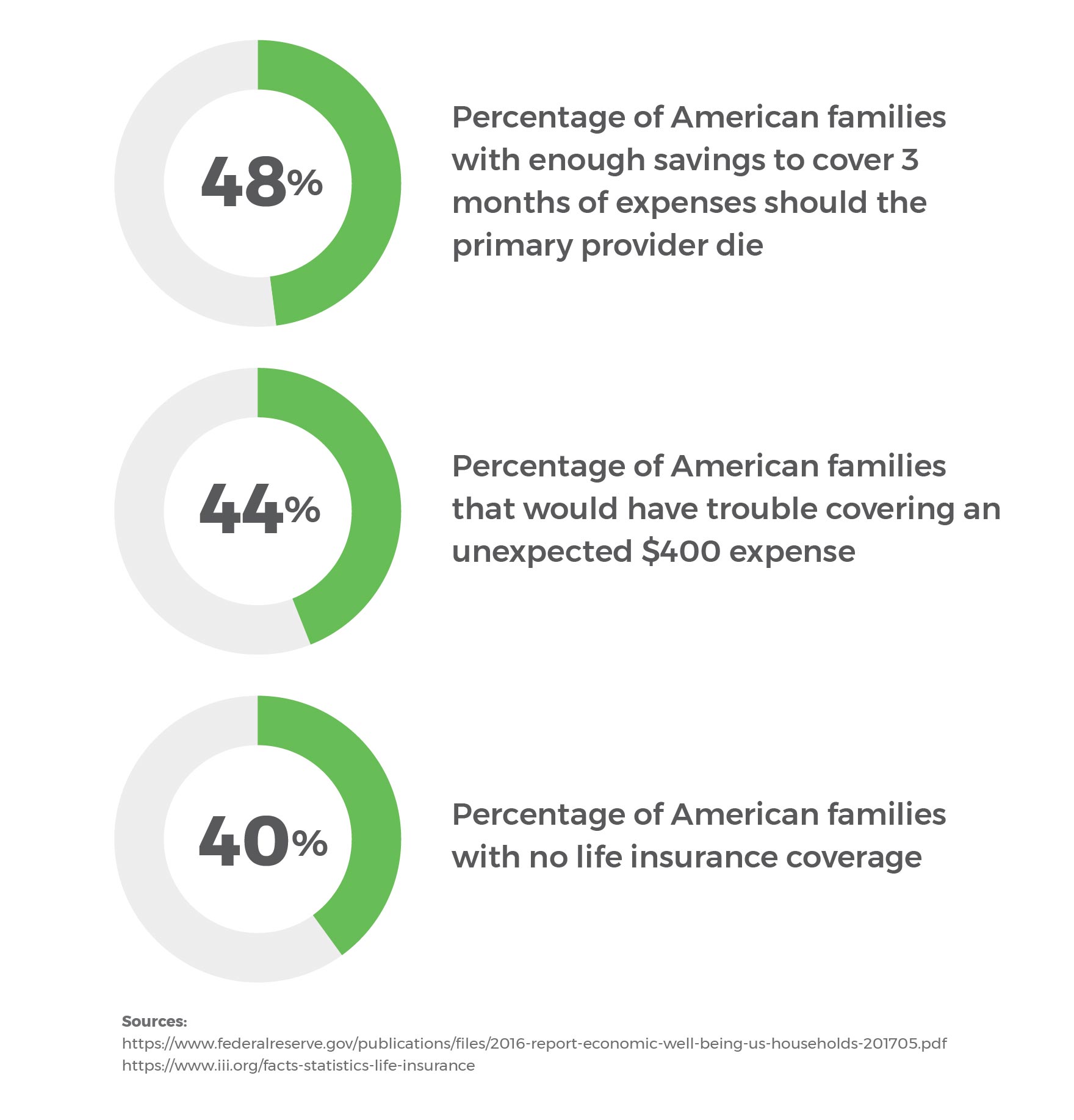

Term life insurance coverage. Depending on what coverage length you decide to go with your premiums are guaranteed not to change. The financial advisors we consulted agree which is why we kept all this in mind when putting together this rundown. Child life accident insurance.

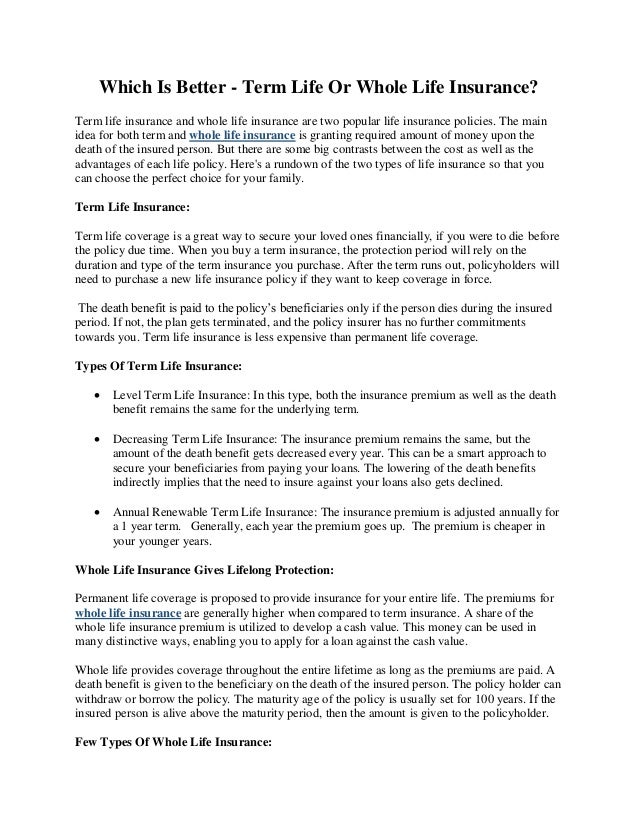

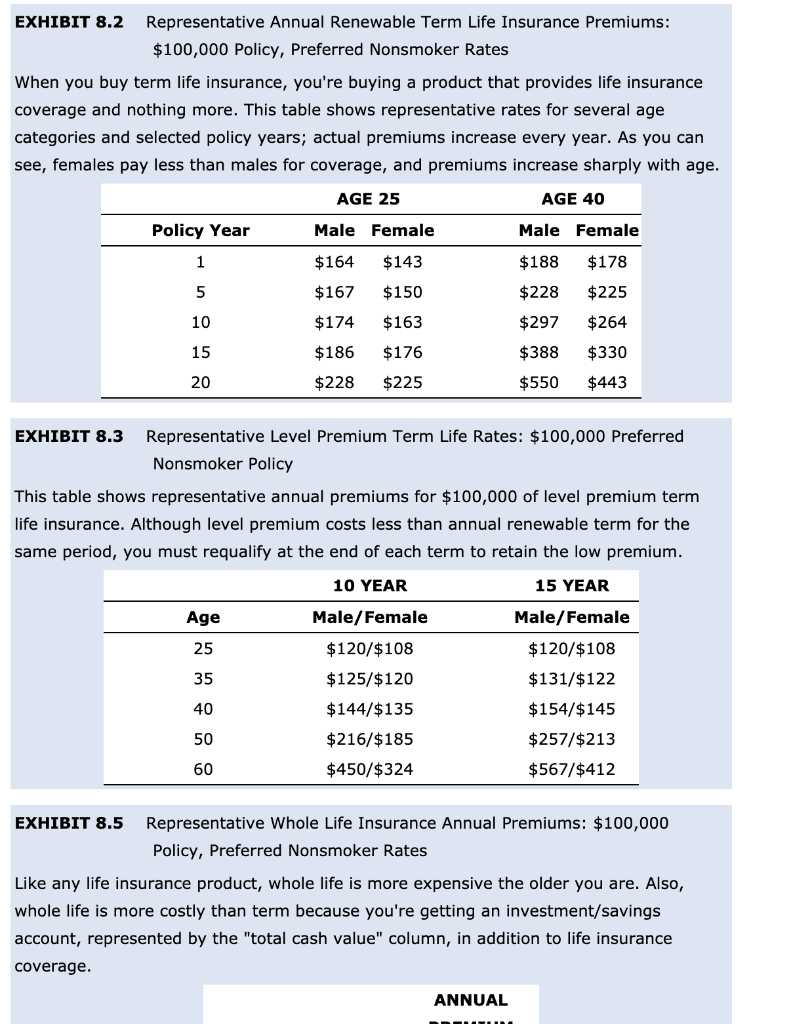

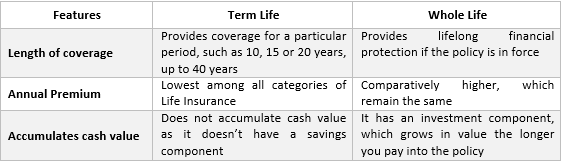

After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years.

There is no savings component as found in a whole life insurance product. If you have children you only want the best treatment for them in case of a serious accident. The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000.

This plan provides up to 500000 in accident protection or 25000 in term life coverage for one low premium that covers all your eligible children. In other words pay one premium every until the end of the term coverage. Help protect your loved ones from the financial impact of your death.

The best term life insurance companies. If the insured dies during the time period specified in the. The best term life insurance companies should issue robust coverage plenty of riders level premiums and term to permanent conversion options.

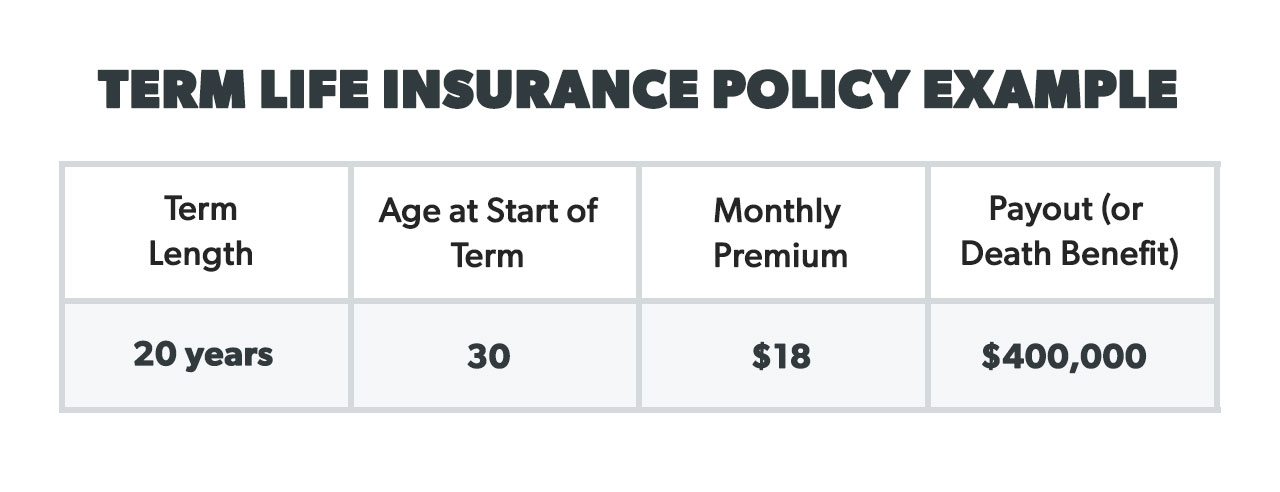

Learn more about the available term life policies and how to get a quote today. Term life insurance policies with larger death benefits will likely include higher premiums while plans with lower coverage amounts will likely be less expensive. Coverage for spouse and dependents.

Term life insurance provide your loved ones with peace of mind. This coverage is excluded as a de minimis fringe benefit. To learn more about how much a term life insurance policy may cost you request a free online quote or speak with a licensed life insurance agent by calling 1 855 303 4640.

A term life insurance policy is a temporary low cost insurance plan. Term life insurance provides affordable coverage for a specific period of time that can help pay for funeral costs day to day expenses and bills.

Term Life Insurance And Whole Life Insurance Quotes For Your Family

Term Life Insurance And Whole Life Insurance Quotes For Your Family

Ways To Promptly Get The Best Term Life Insurance Quote

Ways To Promptly Get The Best Term Life Insurance Quote

A Comprehensive Guide To Life Insurance Policy Term Life Vs

A Comprehensive Guide To Life Insurance Policy Term Life Vs

What Is Term Life Insurance Daveramsey Com

What Is Term Life Insurance Daveramsey Com

1 Million Dollar Term Life Insurance Policy Complete Guide

1 Million Dollar Term Life Insurance Policy Complete Guide

What Are The Different Types Of Life Insurance Policies Market

What Are The Different Types Of Life Insurance Policies Market

Which Is Better Term Life Or Whole Life Insurance

Which Is Better Term Life Or Whole Life Insurance

Term Life Vs Universal Life Insurance

Term Life Vs Universal Life Insurance

Exhibit 8 2 Representative Annual Renewable Term L Chegg Com

Exhibit 8 2 Representative Annual Renewable Term L Chegg Com

Metlife Life Insurance In 2020 A Comprehensive Review

Metlife Life Insurance In 2020 A Comprehensive Review

What Is The Difference Between Term Life And Whole Life Policy

What Is The Difference Between Term Life And Whole Life Policy

30 Year Term Life Insurance Rates Plus Savings Tips

30 Year Term Life Insurance Rates Plus Savings Tips

Life Insurance Policies Rates For Life Insurance Policies

Life Insurance Policies Rates For Life Insurance Policies

What Is Guaranteed Universal Life Insurance And How Does It Work

What Is Guaranteed Universal Life Insurance And How Does It Work

Solved Understanding Term Life Insurance Kristen Is A 25

Solved Understanding Term Life Insurance Kristen Is A 25

Will Term Life Insurance Ever Rule The World

Will Term Life Insurance Ever Rule The World

Search Q Whole Life Insurance Definition Tbm Isch

Two Types Of Life Insurance Term Vs Permanent Life Insurance

Two Types Of Life Insurance Term Vs Permanent Life Insurance

Whole Vs Term Life Insurance What S Better Life Insurance

Whole Vs Term Life Insurance What S Better Life Insurance

0 Komentar untuk "Term Life Insurance Coverage"