Everyone has different needs and term life insurance comes with a few important considerations. In other words the only value.

Do I Need Life Insurance If I M Covered Through Work Policyadvisor

Do I Need Life Insurance If I M Covered Through Work Policyadvisor

Ever wonder what is term life insurance and how does it work.

Term life insurance what is it. Thats why its the best choice for almost everyone. First off with term life insurance you buy a policy for a set number of years usually 10 20 or 30 and the rate is affordable. In fact there are a couple of notable differences.

If you die before the term is up the insurance company pays out. Because you may not need that financial protection anymore and you dont want to pay for an unnecessary insurance policy. It gives you all the coverage you need and none that you dont.

Term insurance is initially much less expensive when compared to permanent life insuranceunlike most types of permanent insurance term insurance has no cash value. What you choose depends on your situation preferences and budget. Term life is not the same insurance product as whole life insurance.

With this type of term policy your monthly payment is the same no matter how long the. The policys purpose is to give insurance to. Term life insurance provides coverage for a set period of time typically from five to 30 years or to a certain age such as 65.

Term life insurance lasts for a set number of years the term before it expires and youre no longer covered. Simply put term life insurance pays a lump sum benefit to someone you designate if you die during a specified term. Whats the difference between term life and whole life insurance.

Buying a term life insurance policy is one way to take care of the financial obligations that will impact your family when you die. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. What is term life insurance and how does it work.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. The most common type of term life insurance is level premium. Term insurance is basic inexpensive and easy to understand.

There is no savings component as found in a whole life insurance product. Why do you want a life insurance policy that runs out. Types of term life insurance.

Before we dive in to the specifics lets go over the basics first. As the name. Fortunately with the help of todays article youll have everything you need to decide if this type of life insurance is right for you.

Term life policies have no value other than the guaranteed death benefit.

Infographic Term Life Vs Whole Life Insurance Low Cost Life

Infographic Term Life Vs Whole Life Insurance Low Cost Life

What Is Decreasing Life Insurance Fairer Finance

What Is Decreasing Life Insurance Fairer Finance

What S Term Life Insurance Quotes

What S Term Life Insurance Quotes

Save Money With Modified Coverage Life Insurance Life Ant

Save Money With Modified Coverage Life Insurance Life Ant

Advantages And Disadvantages Of Term Life Insurance

Advantages And Disadvantages Of Term Life Insurance

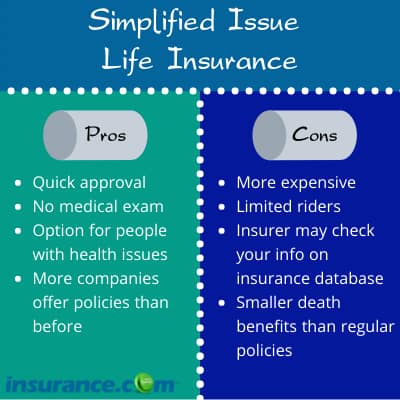

Simplified Issue Term Life Insurance Rates And More

Simplified Issue Term Life Insurance Rates And More

The Definition Of Term Life Insurance And Why You Need It

The Definition Of Term Life Insurance And Why You Need It

How To Compare Term Life Insurance Quotes

How To Compare Term Life Insurance Quotes

Who Needs A 20 Year Term Life Insurance Policy Haven Life

Who Needs A 20 Year Term Life Insurance Policy Haven Life

Characteristics Of Term Life Insurance What Are The

Characteristics Of Term Life Insurance What Are The

Convertible Term Life Insurance

Convertible Term Life Insurance

Ppt Indian Money Reviews Top 5 Reasons To Buy Term Life

Ppt Indian Money Reviews Top 5 Reasons To Buy Term Life

What Happens When Your Term Life Insurance Matures Modest Money

What Happens When Your Term Life Insurance Matures Modest Money

Term Life Insurance Advice From Dave Ramsey Get His 1 Tip Here

Term Life Insurance Advice From Dave Ramsey Get His 1 Tip Here

Term Insurance What Is Term Life Insurance

Term Insurance What Is Term Life Insurance

Ask An Agent Term Life Insurance Allstate

Ask An Agent Term Life Insurance Allstate

Short Term Life Insurance Know Your Options

Short Term Life Insurance Know Your Options

Term Vs Whole Life Insurance What S The Best Option For You

Term Vs Whole Life Insurance What S The Best Option For You

What Kind Of Life Insurance Is Cheaper I M Not Sure About Term Vs

What Kind Of Life Insurance Is Cheaper I M Not Sure About Term Vs

Life Insurance Facts Term Life Insurance Versus Whole Life

Life Insurance Facts Term Life Insurance Versus Whole Life

Ppt What Is Term Life Insurance Powerpoint Presentation Free

Ppt What Is Term Life Insurance Powerpoint Presentation Free

0 Komentar untuk "Term Life Insurance What Is It"